Colosseum Codex: Kora, Solana 2025, LazorKit Cookbook

Kora, Solana Keychain, Solana 2025 Stats and Dominance, LazorKit Cookbook

Here's what's featured in this week's issue:

- Solana Foundation Launches Kora for Sponsored Tx Fees

- A Look at Solana's Incredible Year in Data

- DeFi Development Corp Report Shows Solana’s 2025 Dominance

- LazorKit Cookbook Shows How To Bring Web2 UX To Solana

⛽ Kora

Kora is a Solana Foundation maintained paymaster and signing service for gasless and multi-asset fee payments so users do not need SOL and applications can collect fees in USDC, BONK or a native token.

It is built on Solana Keychain, a unified interface for signing Solana transactions across multiple backends, including AWS KMS, Fireblocks, Privy, Turnkey, HashiCorp Vault and in memory.

Kora is configured through a TOML file where operators define fee payer policies for SPL Token program and Token22, control which methods are enabled, and set program, token and user allowlists or blocklists.

It exposes a JSON RPC 2.0 API and a TypeScript SDK, supports Solana keypairs as well as managed signing backends, and includes validation rules, Redis caching, rate limiting, spend protection, secure key management and Prometheus metrics.

Kora has been fully audited by Runtime Verification, and the Solana Foundation has published a quick start guide and x402 examples to help teams get started.

📊 Solana 2025

Solana’s 2025 data paints shows an ecosystem that is growing, monetizing, and deepening liquidity at scale.

Apps on Solana generated $2.39 billion in revenue, up 46% year over year, with seven individual apps each clearing $100 million. Importantly, the long tail of smaller apps still captured over $500 million, suggesting that value is not concentrated in a single winner but spread across a range of onchain products.

On the network side, Solana recorded $1.4 billion in validator revenue, 33 billion non-vote transactions, and an average of 3.2 million daily unique active wallets, all while keeping the median fee at roughly one tenth of a cent.

Assets and trading show Solana becoming a serious settlement layer for global value. Stablecoin supply ended at $14.8 billion with $11.7 trillion transferred, DEX volume hit $1.5 trillion, and SOL was a pair asset in 42% of all trades.

Add growing Bitcoin, tokenized assets, AI agent volume, and nearly $1 billion in pro trading platform revenue, and you get a credible case for Solana being the choice for new onchain markets.

2025: The year of revenue, assets, and trading

🏆Solana's 2025 Dominance

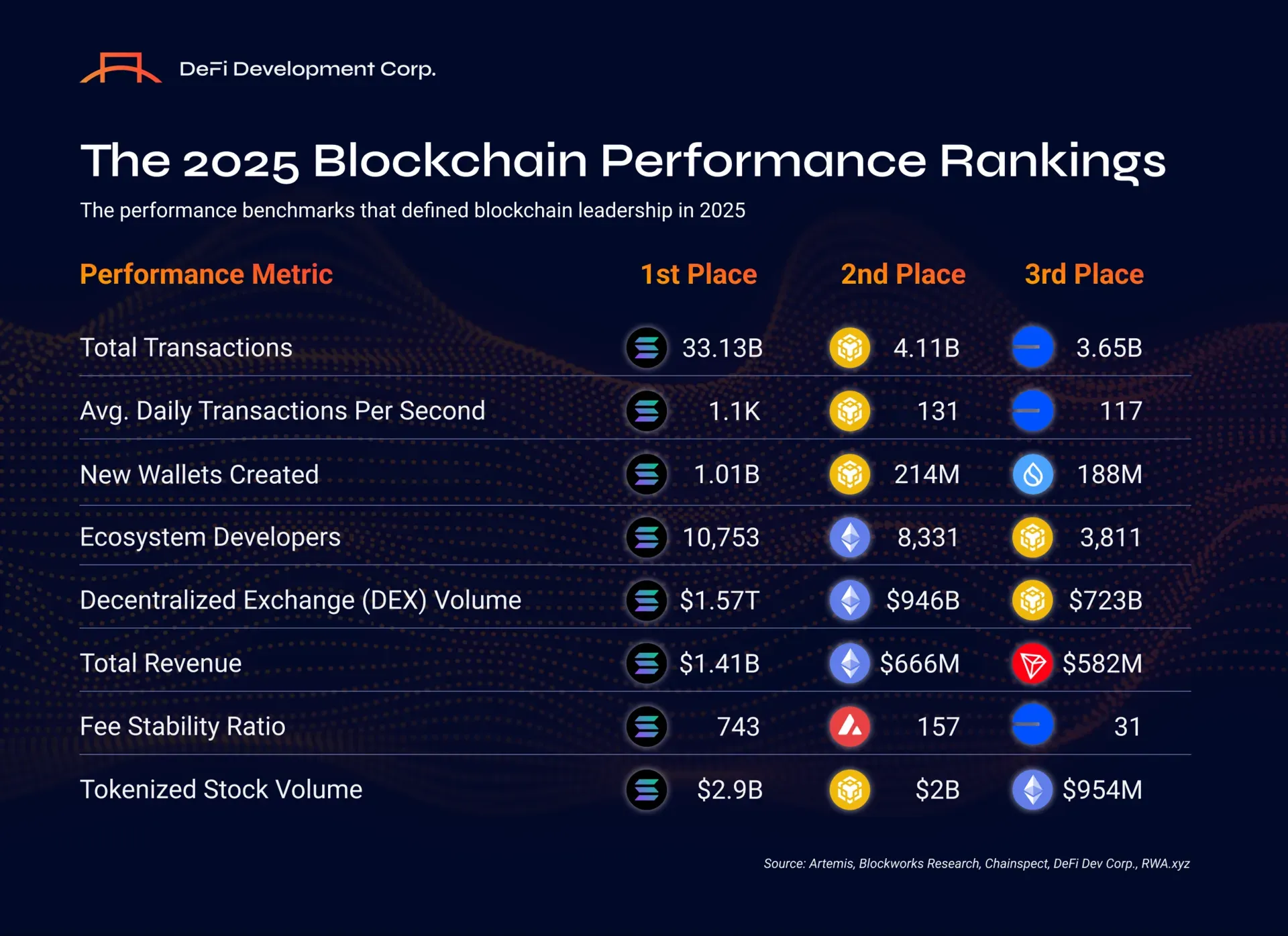

A new report from DeFi Dev Corp positions Solana as crypto’s clear winner in 2025 and offers another look at how successful the network has become. Across nearly every core metric, Solana is presented as having moved from competitor to dominant smart contract platform.

The report notes that Solana processed about 33B transactions in 2025, more than 2.5 times every other major blockchain combined, and averaged over 1,100 TPS for the year. Ethereum handled roughly 520 million transactions.

User growth tells the same story. Solana added around 1B new wallets, roughly 50% year over year, versus 47 million on Ethereum.

Developers are following that demand. The report estimates Solana at roughly 10,753 active developers, ahead of Ethereum’s 8,331.

Solana became the largest onchain trading venue with about 1.57 trillion dollars in DEX volume and roughly 1.41 billion dollars in onchain fee revenue, overtaking Ethereum while keeping fees low and stable.

Finally, the report highlights Solana’s early lead in tokenized equities, with about 2.9 billion dollars in stock trading volume in only six months. Taken together, the findings suggest Solana has reached durable product market fit at global scale.

The takeaway is that the smart contract war is no longer being decided by whitepapers or narratives, but by usage, liquidity, and economic gravity, and today, those are centered on Solana.

Crypto’s Winner of 2025: Solana

👩🍳 LazorKit Cookbook

The LazorKit Cookbook is a new, open source guide that shows how LazorKit can bring Web2 level UX to Solana while still keeping everything onchain. Instead of focusing on theory, it presents concrete “recipes” with live demos and full code that developers can copy, adapt, and extend.

At a high level, the cookbook tackles the biggest Solana UX pain points: seed phrases, browser extensions, SOL for gas, and constant signature prompts. LazorKit replaces them with passkey based wallets that use Face ID or Touch ID, gasless token transfers using a paymaster, and sign once flows for complex products like subscriptions.

Some of the recipes include:

- Face ID wallets without seed phrases

- Gasless USDC transfers where users never touch SOL

- Subscription Service (POC) with Automated recurring payments on Solana

The cookbook gives Solana developers a concrete toolkit for building passkey native, gas abstracted applications that feel familiar to mainstream users while still leveraging onchain guarantees.

⚡ Quick Hits

Solana Noir Examples: ZK circuits in Noir with onchain verification - @dev_jodee

Introducing stORE (staked ORE), a liquid staking token for ORE - @OREsupply

The ZK Privacy Paradox: Why Solana's Killer Feature Remains Its Missing Piece - @ImAHappyWriter

NAV Strikes on Solana Explained: Instant Settlement Tutorial & Live Demo (video) - Jonas Hahn

Quicknode 2025 Year in Review: How Web3 Infrastructure Scaled - Quicknode

MagicBlock RFP: Pay-Per-Byte File Network - @magicblock

Solana Social Media Presence Playbook 101 - @Hogwartsofweb3

⚙️ Tools & Resources

solana-keychain provides a unified interface for signing Solana transactions with multiple backend implementations.

tx-indexer is a Solana transaction indexer and classification SDK that transforms raw blockchain transactions into categorized, user-friendly financial data.

solana-anchor-ai-rules is a collection of Claude/Cursor AI rules for building Solana projects with Anchor.

pinocchio-amm is a lightweight Automated Market Maker (AMM) implementation built with Pinocchio that implements a constant product AMM with LP tokens, swaps, and liquidity management.

barrel is a CLI for AI-assisted development with portable agents across LLMs and reproducible terminal workspaces.

💀 RIP

Paladin is shutting down because the upcoming MCP upgrade, expected in 2027, will make its core purpose obsolete. Paladin was built to help validators earn more by not frontrunning, using out-of-protocol incentives, and block building. With MCP is designed to solve frontrunning and related issues directly in the Solana protocol, Paladin’s role is effectively complete.

Lifinity is shutting down after its community overwhelmingly voted to terminate the protocol amid rising competition, declining volumes, and providing liquidity with its own funds no longer a sustainable model. Its treasury is being converted to USDC and returned proportionally to LFNTY holders via a redemption process, with unclaimed funds later airdropped.

👩🔧 Get Hired

- Defituna is hiring a Rust Backend Senior/Lead Developer

- Jito Labs is hiring a Senior Systems Engineer - Performance

- Pye is hiring a Developer Relations (Solana Validators)

- Crossmint is hiring a Full-stack Engineer - Wallets/Minting (US)

🎧 Listen to This

Lightspeed

Matty Taylor joins Lightspeed to discuss what’s next for Colosseum in 2026 and where he sees the biggest opportunities.

He breaks down the Colosseum model and how Accelerator Cohort 4 fits into the pipeline from hackathons to funding and ecosystem support. The conversation then shifts to where to allocate in 2026, with a focus on categories poised to drive onchain activity, especially on Solana.

Matty digs into crypto’s token vs equity problem and takes a look forward to Solana DeFi in 2026.

Where To Allocate In 2026 | Matty Taylor

Follow me on X!

Thanks for reading ✌️

I hope you found something useful here! If you have any suggestions or feedback just let me know what you think.