Introducing the Colosseum STAMP

Simple Token Agreement, Market Protected

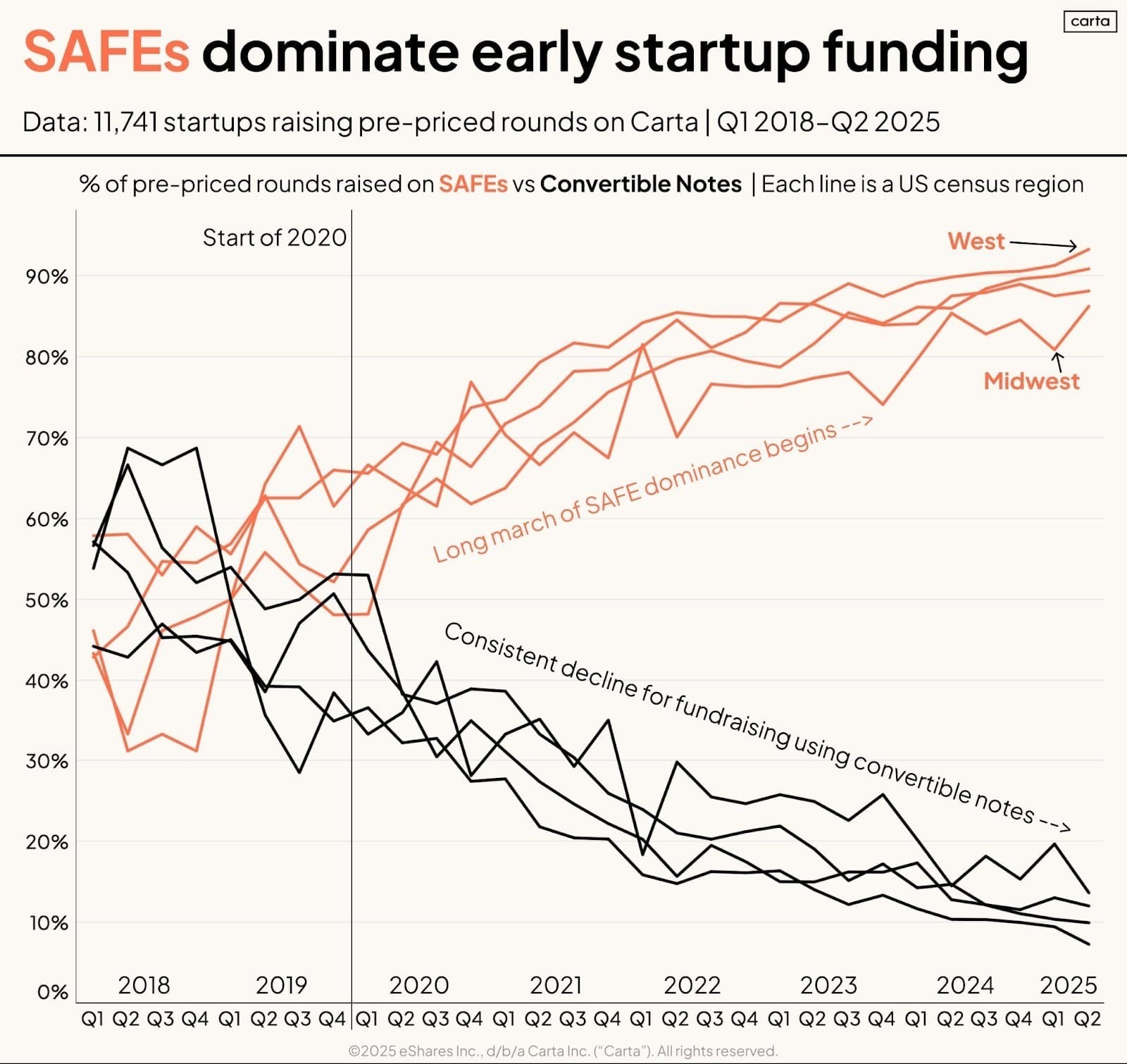

Over the past decade, Y Combinator transformed startup fundraising with the SAFE (Simple Agreement for Future Equity), a more practical alternative to convertible notes and priced rounds. As crypto venture kicked off, the SAFT (Simple Agreement for Future Tokens) emerged to handle token issuance, but ultimately left the question of equity unaddressed. Eventually, a hybrid structure of SAFE + token warrant became the instrument most crypto founders and funds use today.

While the SAFE remains useful, crypto startup investing is evolving and it's not sufficient for the next era. In particular, the dual equity + token structure it creates has led to subpar outcomes for crypto startups. Outcomes that are at best confusing for tokenholders, and at worst highly extractive. The status quo is also unnecessarily costly and puts pressure on founders to decide at each step where project value accrues. Crypto-native founders and their investors deserve an instrument that ensures the token is the sole economic unit. That’s why we are excited to introduce the Colosseum STAMP (Simple Token Agreement, Market Protected).

The STAMP is a new investment contract providing alignment between crypto startups and their investors leading up to a MetaDAO ICO (initial coin offering), which ensures tokenholders onchain protections via decision markets. The STAMP was crafted in partnership with Orrick, a leading tech law firm, and starting today, we are offering the STAMP as an alternative to our SAFE + token warrant to founders raising capital from Colosseum.

Download the Colosseum STAMP and learn more at colosseum.com/stamp

MetaDAO, Futarchy, and Market Protection

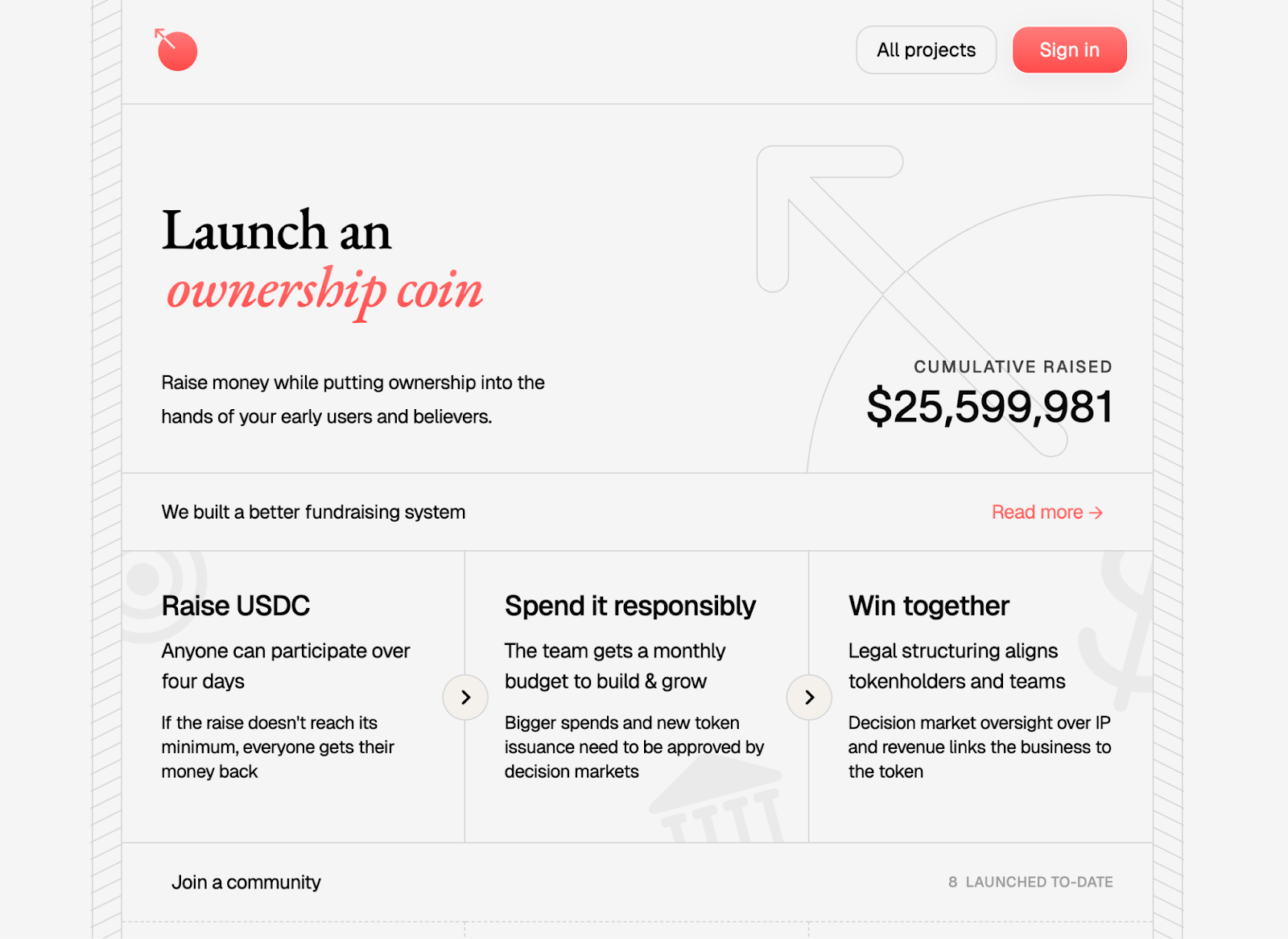

For years, our industry has attempted to create open, permissionless protocols where anyone, anywhere could raise funds directly onchain. There were flashes of progress during the ICO bubble of 2017, DeFi summer in 2020, and with memecoin launchpads over the past 2 years. Despite this progress, each iteration struggled to square that permissionlessness with investor protections and clarity. MetaDAO’s implementation of decision markets (futarchy) was the breakthrough that we believe has made it possible to design a truly robust fundraising process for both founders and investors.

MetaDAO leverages decision markets to give tokenholders actual ownership over project treasuries and intellectual property. This means ICOs that launch Ownership Coins are protected from rugs, allow true value accrual to tokens, and ensure capital can be fairly returned if a project fails. Colosseum was the first venture fund to invest in MetaDAO, and over the past year we’ve seen firsthand how well these mechanisms work in practice.

However, a few gaps remain. Many founders want to raise a reasonable amount of seed capital from angels or venture funds like Colosseum before launching a token, while others already have an equity structure with existing investors. The STAMP solves key issues for these teams dealing with antiquated legal contracts, term sheets, and equity structures leading up to and after an ICO. Founders need a standardized method to accept private capital and dissolve their legacy equity structure, while creating a MetaDAO-compliant entity to eventually run an ICO.

Until now, there has been no mechanism to bridge private investment into a public MetaDAO ICO, to provide investors protection before token generation, nor to give founders a clean migration process for their existing cap tables. These are exactly the gaps the STAMP fills.

How the STAMP Works

Colosseum’s STAMP gives investors a legally enforceable claim on a project’s token supply while protecting both sides during the period of time from the initial, offchain investment to the onchain ICO. And there are two types of founders the STAMP is designed to support: founders with no existing legal entity/structure and founders with an equity structure + investor cap table.

For new startups, they first need to set up a Cayman SPC/SP entity through the MetaDAO interface. Then, the investor can sign a STAMP and send funds (typically stablecoins) into the startup’s wallet attached to the new entity. These funds can only be used for product development and operating expenses, and upon the project’s ICO, the remaining balance is transferred to the project’s DAO-controlled treasury along with the IP.

Each investor who signs the STAMP is allocated a fixed portion of the project’s future token supply. The Investor Reserve must be equal to or below 20% of all project tokens. This removes ambiguity, eliminates post-hoc renegotiation, and provides a predefined token entitlement that cannot be diluted or reinterpreted later. When the ICO occurs, investors simply submit a Delivery Notice to receive their tokens. Tokens enter a 24-month linear unlock schedule once the Delivery Notice is received.

The STAMP also specifies a milestone-based team allocation, with a minimum of 10% and a maximum of 40% of the total token supply. The purpose of this, in combination with the Investor Reserve limit, is to ensure an adequate percentage of tokens are available to ICO participants.

Crucially, this agreement also serves founders with existing equity structures. These founders will also need to create a Cayman SPC/SP entity prior to signing the STAMP. Any SAFE, note, or other convertible previously held by a STAMP investor is terminated and replaced upon signing of the STAMP, simplifying the cap table migration and avoiding dual equity + token issues down the road. Private investors will receive the token amounts specified in their existing token warrants (or previously agreed upon contracts), and receive market-protected governance once the ICO occurs. Just like all liquid tokenholders.

In summary, founders gain a clean, unified structure that preserves autonomy while guaranteeing transparency and cost-effectiveness. And the STAMP creates a bridge for investors from traditional equity ownership to ownership enforced onchain.

A Standard for the Crypto Venture Ecosystem

Unlike prior instruments that treated tokens as accessories to equity, the STAMP is an investment contract that helps solidify the token as the sole economic unit of a crypto-native business: governed, protected, and aligned via the MetaDAO protocol.

Unprotected investors and tokenholders no longer need to speculate on tokens that are detached from the fundamentals of projects. And capital markets gain a credible structure to allocate significantly into protocols and onchain businesses.

Over time, investors will demand token-based projects launch through MetaDAO where decision market protections are hard-coded, similarly to how equity holders demand specific protections today. Therefore, crypto startups that adopt the STAMP early will get access to a deeper, higher-quality pool of capital and a governance model built for long-term success.

Finally, the Colosseum STAMP is not just for Colosseum. We drafted the contract so that it can be used across the venture ecosystem as a standard for trust and long-term alignment as tokens become an integral component of the global financial system.

Download the Colosseum STAMP and learn more at colosseum.com/stamp.