Colosseum Codex: Internet Capital Markets, CU Optimizations, Jupiter Verify v4

Internet Capital Markets Roadmap, Transaction Costs and Compute Units, Jupiter Verify v4, Pipe Network Firestarter Storage, Functional vs. Expressive Social Media Content

Here's what's featured in this week's issue:

- The Internet Capital Markets roadmap from Anza

- Why Solana transaction costs and compute units matter for developers

- Jupiter Verify gets a major upgrade with v4

- Pipe Network debuts Firestarter Storage for Solana developers

- How expressive posts amplify functional brand content

🚅 Internet Capital Markets Roadmap

Internet capital markets are global, always-on systems where assets, identities, and trades live on a shared ledger. Solana was built for this with its high throughput, low latency, and cheap transactions.

Application‑Controlled Execution (ACE) makes execution ordering an application primitive. Instead of validators deciding how transactions line up inside a slot, each program can encode its own sequencing rules.

Think of it as a programmable sequencing layer that sits next to your program logic rather than a one‑size‑fits‑all policy baked into the network.

The ICM roadmap delivers ACE in layers so it works at internet speed.

Near term, Jito’s Block Assembly Marketplace gives ACE‑like custom intra‑slot sequencing through plugins with public attestations, while Anza’s landing upgrades make same‑slot inclusion more reliable.

Medium term, DoubleZero cuts propagation latency and jitter and increases bandwidth, Alpenglow targets roughly 150 ms finality and simplifies consensus, and Asynchronous Program Execution removes execution replay from the landing path.

Long term, Multiple Concurrent Leaders reduce censorship risk by allowing many leaders to include transactions in the same window, then the protocol enforces application‑defined sequencing onchain.

Together, these pieces give builders programmable, verifiable ordering with low latency and high throughput, enabling fully onchain markets that operate globally and continuously.

This roadmap gives a clear path to how Solana plans to power internet capital markets and what that means for builders.

The Internet Capital Markets Roadmap

🏷️ Transaction Costs and Compute Units

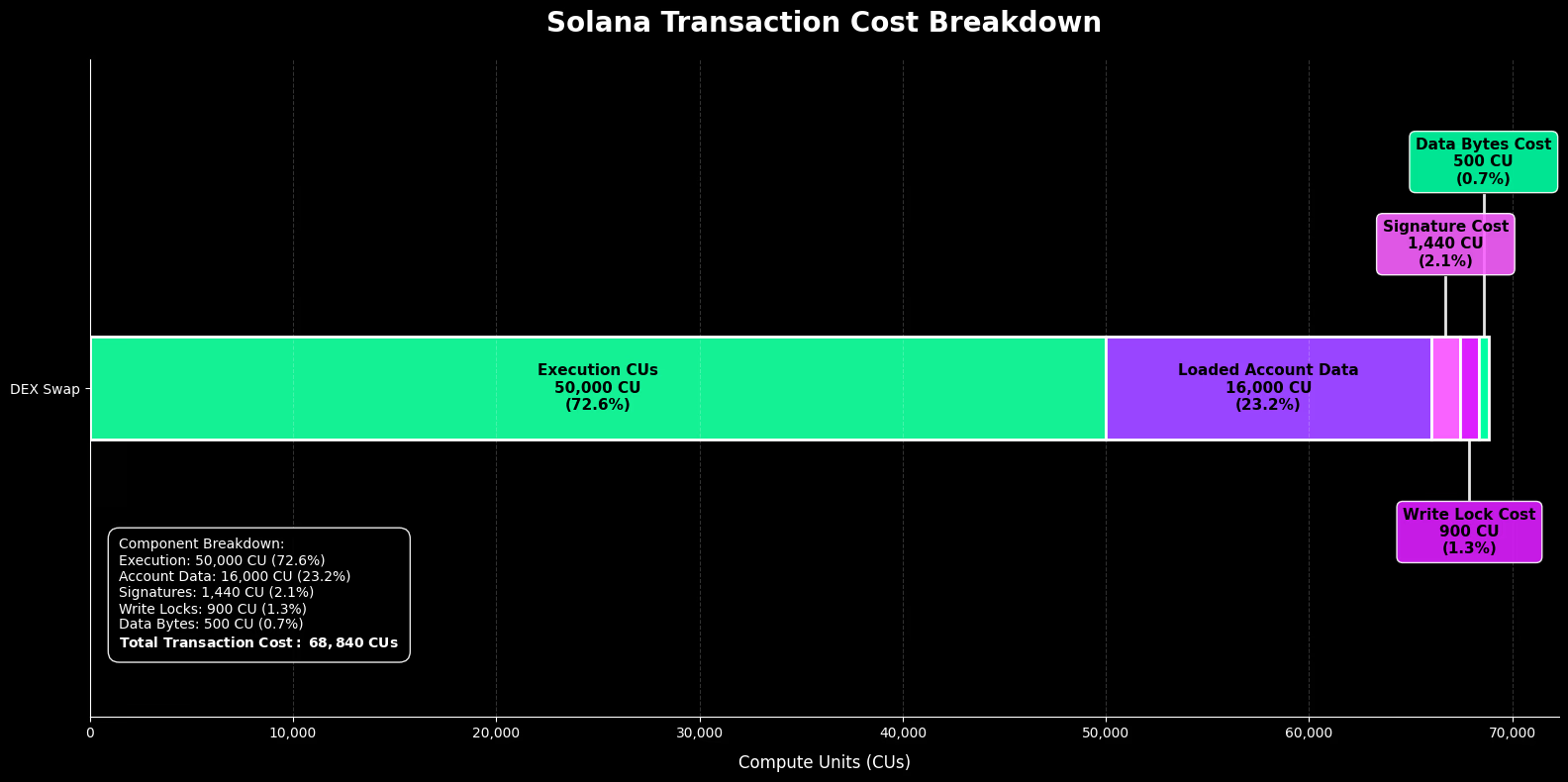

This post from Anza gives developers a clear, practical model for why optimizing compute units matters and how to do it.

Compute units measure all work a transaction consumes, from program execution to overhead like signatures, write locks, loaded account data, and payload size. Leaders pack blocks based on transaction cost in compute units, while your priority fee is calculated only from execution compute units

This article breaks down the differences between Compute Units, Transaction Cost, and Transaction Fee.

- Compute Units (CUs): The runtime meter of work your program executes.

- Transaction Cost: Total resource usage measured in CUs, including execution plus overhead like signatures, write locks, loaded account data, and bytes; used for block packing.

- Transaction Fee: Lamports you pay, combining base fees and an optional priority fee.

The full article provides specific, step‑by‑step guidance on optimizing compute units to raise priority, improve landing rates, and keep transactions reliable as Solana scales.

Why Solana Transaction Costs and Compute Units Matter for Developers

🐱 Jupiter Verify v4

Jupiter Verify v4 is a significant upgrade to Solana’s shared token verification system used across wallets and trading terminals via Jupiter’s free Token API.

It targets imposter tokens with faster reviews, clearer criteria, and public status tracking through a form-based process. Validation now considers X followers alongside a curated set of “Smart Followers” to limit bot influence.

The system offers two paths:

- Free, community‑driven standard review monitored continuously

- Express lane that guarantees review within 24 hours if the creator burns 1,000 JUP, with automatic rechecks for three days if needed.

Decisions weigh six factors in combination:

- Organic Score

- Social validation

- Ticker uniqueness

- Market cap

- Holder distribution

- Onchain liquidity

Starting one week after rollout, tokens with low Organic Score and insufficient real volume will be removed.

The result is a faster, harder‑to‑game verification list that gives builders a transparent reference for token discovery.

🔥 Pipe Network Firestarter

Firestarter Storage, a new offering from Pipe Network, brings decentralized storage and content delivery to Solana developers, aiming to replace Web2 options like Cloudflare and AWS with a fully decentralized alternative.

Until now, Solana developers had to choose between centralized services or duct-taped solutions using IPFS or Arweave.

Firestarter combines origin storage, CDN delivery, and edge compute into a single decentralized system, enabling developers to serve anything from video to AI workloads with built-in micropayments, geo-pinning, and low-latency edge performance.

With this release, Pipe aims to become Solana’s decentralized foundation for real-time, high-performance content distribution.

For developers, this unlocks features like per-byte streaming payments, data locality controls, and edge compute at the point of presence level.

Pipe Network debuts Firestarter Storage for Solana developers

💬 Functional vs. Expressive Content

This post offers a case‑study‑driven look at why brand accounts should mix personality‑forward posts with informational updates instead of relying on formulaic calls to action.

It explains how expressive content primes both algorithms and audience affinity, which lifts the reach and effectiveness of your posts.

You’ll learn the difference between expressive and functional content and when to use each, a simple framework for balancing them in your content calendar, how engagement dynamics on X can amplify the reach of later posts, and how leading accounts apply this approach with takeaways you can implement quickly.

Functional vs. Expressive Social Media Content

⚡ Quick Hits

Solana Mobile Hackathon Pitch Resources and DePitch Academy Masterclass - @KEMOS4BE

10 most popular Solana beginner questions (video) - QuickNode

DoubleZero launches 3M SOL stake pool - @doublezero

Orca releases Wavebreak launchpad for Solana tokens - Blockworks

New AppKit Feature: Pay with Solana - @reown_

Solana Made Simple weekly live stream announced - @julestrades

⚙️ Tools & Resources

solana-github-actions is a CI pipeline that builds Rust projects, compiles Solana SBF programs, runs unit and integration tests, enforces Clippy and formatting checks, and caches dependencies to speed up subsequent runs.

whitelist-transfer-hook is an example that implements an SPL Token 2022 transfer hook that enforces a whitelist, allowing only approved addresses to transfer the token.

anchor-coverage-example is a guide on how to set up code coverage analysis for Anchor programs.

sbpf-profiler is a fork of Solana's SBPF VM that adds execution profiling and generates flame charts showing function-level compute unit usage across program and CPI boundaries.

multising_pinocchio is an example Multisig program on Solana using Pinocchio for low-level precision.

💀 RIP

Subs.fun is winding down after a short run exploring tokenized interests and launchpad-style tokenized forums. The team cites the need to build a full social layer once tokens meet social as a scope they are not ready to take on now despite traction of a few thousand users, 72,000 posts, and over $35 million in sub‑coin trading volume. Users can withdraw funds now through Sept. 18.

👩🔧 Get Hired

- Jito Labs is hiring a DevRel Engineer

- Phantom is hiring multiple engineering roles

- Sphere is hiring multiple engineering roles

- io.net is hiring a Solutions Architect

🎧 Listen to This

Solana Weekly

In this episode of Solana Weekly, host Thomas Bahamas welcomes Alex, CEO of Nansen, a leading crypto analytics platform often dubbed the "gold standard" for on-chain data and analytics.

The discussion dives into the evolving crypto market, the convergence of traditional finance (TradFi) and crypto through tokenized assets, reflections on market cycles, Solana's positioning in the "chain wars," and an in-depth look at Nansen's tools, features, and future AI-driven innovations.

The conversation highlights the shift from "toy world" speculation (e.g., meme coins, NFTs) to real-world asset (RWA) integration, regulatory challenges, and how Nansen democratizes advanced analytics for retail and institutional users alike.

Nansen CEO Alex Talks Crypto Cycles and OnChain Analytics

Follow @mikehale on X or Warpcast!

Thanks for reading ✌️

I hope you found something useful here! If you have any suggestions or feedback just let me know what you think.