Colosseum Codex: State of Solana Q4, Prop AMM Challenge, Kamino BuildKit

Messari State of Solana Q4 2025 Report, Kamino BuildKit, Prop AMM Challenge, Stake-Weighted Governance

Here's what's featured in this week's issue:

- Messari releases State of Solana Q4 report

- Prop AMM Challenge

- Kamino launches BuildKit TS SDK and REST API toolkit

- Exo and Turbin3 release a stake-weighted governance system

📊 State of Solana Q4

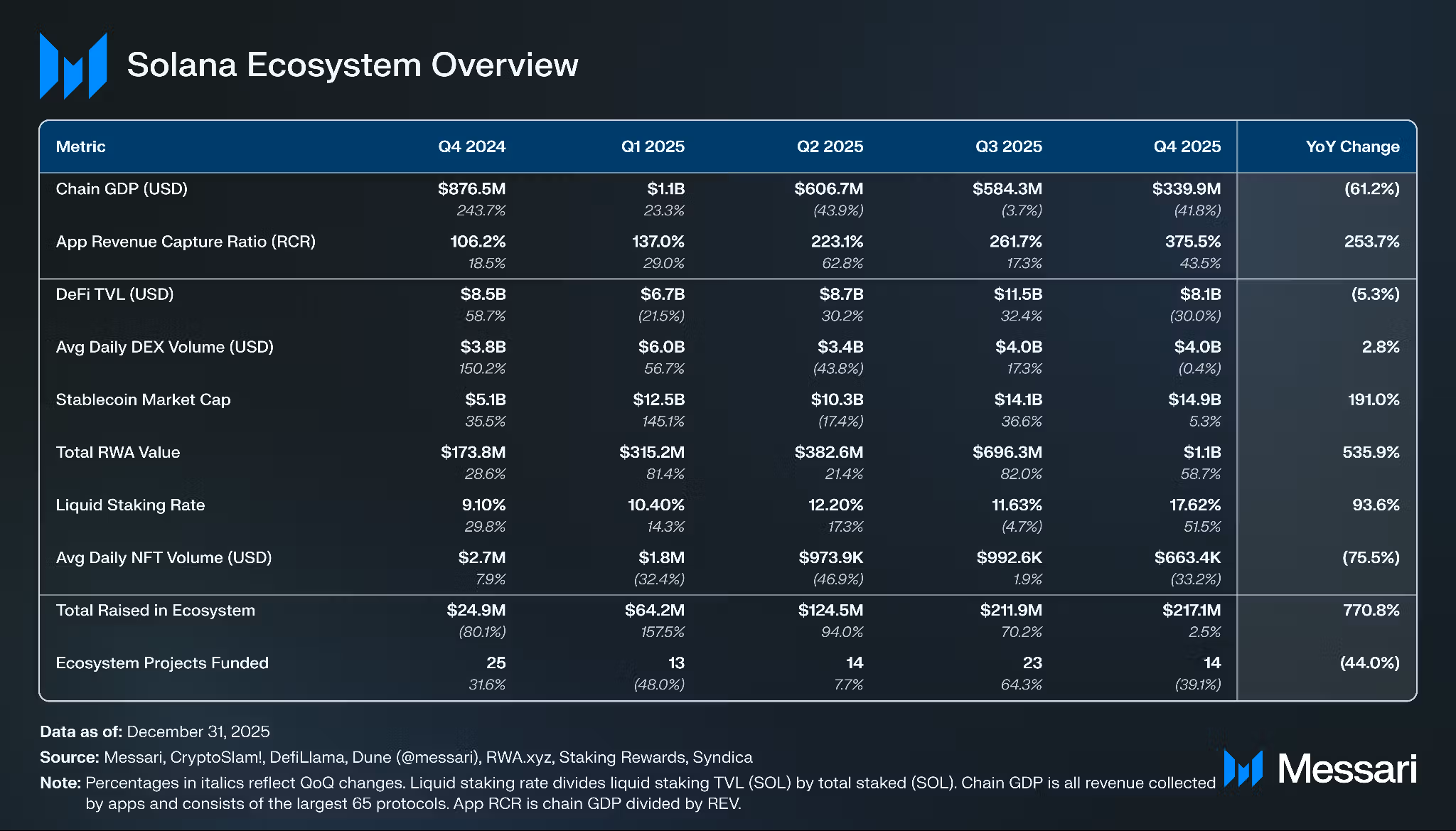

Messari released its Q4 2025 Solana report, covering ecosystem performance through the end of December. The quarter was defined by maturing application monetization and infrastructure development, even as transaction volumes cooled from October highs.

Some key highlights include:

- Alpenglow is approaching testnet (expected Q1/Q2 2026). The new consensus protocol replaces Proof of History and Tower BFT, targeting 100–150ms finality from ~12.8s and eliminating per-slot vote fees, lowering validator overhead.

- Firedancer passed 100 days on mainnet, making Solana the first L1 with two distinct validator clients in production. Another 20.6% of stake runs Frankendancer.

- AI agent infrastructure matured: Solana leads x402 payment volume, and builders shipped "skills" for onchain trading, staking, and DeFi execution.

- Block building options expanded: Jito BAM (11.4% of stake) adds verifiability and programmability to the transaction pipeline. Harmonic (2.9% of stake) lets validators auction blocks from competing builders.

- Coinbase enabled trading for all Solana tokens through its app on Jan. 23, 2026, expanding distribution for any SPL token.

Solana's structural metrics headed in the right direction. Stablecoins hit an all-time high of $14.9B, RWAs grew 58.7% QoQ to $1.1B, and five SOL ETFs launched in Q4 with $1B in cumulative flows.

The App Revenue Capture Ratio reached 375.5%, up from 261.7% in Q3, meaning leading protocols are capturing more value per dollar spent on the network.

14 projects announced funding rounds with a total combined raise of $217 million.

The full Messari State of Solana Q4 2025 report covers DeFi protocol breakdowns, perp DEX rankings, DePIN network stats, gaming revenue, and a detailed financial analysis of REV and validator economics.

🏅 Prop AMM Challenge

The Prop AMM Challenge is a mechanism design contest where participants write custom swap functions for a proprietary AMM built on the Solana VM.

Strategies are written in Rust, compile to BPF bytecode, and run in a sandboxed environment against 1,000 randomized simulations varying volatility, normalizer fees, and liquidity depth.

Scoring is based on the average profit margin against true market price:

- Positive edge comes from retail order flow (spread capture)

- Negative edge comes from arbitrage bots exploiting stale pricing.

Strategies must implement two instructions: compute_swap for pricing trades and afterSwap for updating persistent state.

Starter code is available on GitHub. The leaderboard already shows 100+ submissions, with top entries exceeding 590 basis points of average edge.

🧰 Kamino BuildKit

Kamino launched BuildKit, a TypeScript SDK and REST API toolkit that lets apps embed Kamino's yield and lending products directly without rebuilding the underlying infrastructure.

BuildKit covers two product lines:

- Earn side: Developers get programmatic access to Kamino Vaults, deposits, withdrawals, vault data, historical analytics, and custom vault deployment with configurable performance and management fees. Vault creators receive a revenue share from deposits.

- Borrow side: The Lend SDK handles user position tracking, PnL data, borrow and repay transactions, LTV calculations, and historical yield and liquidity metrics.

Both integrate via TypeScript SDK or REST API with working code examples throughout the docs.

🗳️ Decentralized Governance

Exo Technologies and Turbin3 have built a stake-weighted governance system that lets Solana's 1.2 million stakers vote independently of their validators, using off-chain snapshots verified on-chain via Merkle proofs.

The system uses a two-tier Merkle tree:

- A MetaMerkleTree holding all validators with stake roots

- Per-validator StakeMerkleTrees for individual delegators

Operators generate snapshots off-chain via CLI and submit computed Merkle roots on-chain. Consensus triggers when sufficient operators agree. The system supports native staking, SPL stake pools, Marinade, and Sanctum.

Stakers can override their validator's position on any active proposal. Governance parameters:

- 15% of stake required to sponsor a proposal

- 3-epoch (~6 day) voting window

- 33% quorum

- 66% supermajority to pass.

The build responds to SIMD-228, a dynamic inflation proposal that had 61% validator support but failed the 66% threshold while delegators had no independent vote.

Building Decentralized Governance for Solana: Giving 1.2M Stakers a Voice

Want early access to the latest products launching from Colosseum?

We're looking for alpha testers to be among the first to try what we're building!

⚡ Quick Hits

Crypto is not cool (again) - Clay Robbins

Why build on Solana? with Jacob Creech (video) - @TheBAFNetwork

Introducing the Phantom MCP Server - @phantom

DFlow MCP: Instant Source Access for Agents - @dflow

x402 on Quicknode: Instant Blockchain Access for Developers and AI Agents - Quicknode

Solana Dev Sessions: Zero-knowledge proofs with dynamic public inputs (video) - @solana_devs

Introducing Altitude Bill Pay - Squads

⚙️ Tools & Resources

openclaw-solana-connect is a purpose-built toolkit that enables autonomous AI agents running on OpenClaw to interact with the Solana blockchain securely.

Sol-Radar is an automated tool that continuously scrapes, analyzes, and synthesizes data from across the Solana ecosystem to surface emerging narratives, rank them by momentum, and generate actionable product ideas for builders.

gobble is a transaction simulation harness that detects when Solana programs read forbidden bytes from instruction data via the instructions sysvar. This identifies malicious AMMs that snoop on slippage parameters to provide worse fills during CPI.

renderers-js-web3js provides a Codama renderer for Web3.js to generate type-safe client code for Solana programs powered by @solana/codec for encoding & decoding

solchit-fund-3.0 is a decentralized rotating savings protocol (ROSCA/Chit Fund) built wiht Anchor that replaces the traditional trust-based chit fund organizer with deterministic on-chain logic, transparent accounting, and program-controlled vaults.

👩🔧 Get Hired

- Panthom is hiring a Software Engineer, Frontend/Full Stack

- Solana Foundation is hiring an Infrastructure Engineer

- Anza is hiring a Senior Software Engineer, Generalist

- MetaDAO is hiring a Staff Engineer

- Quicknode is hiring a Support Engineer II

📅 Event Calendar

Solana & Rust Development Workshop, Ankara, Turkiye, Feb 26

A hands-on Solana development workshop is scheduled for February 26 in Ankara, Türkiye. The session covers the accounts model, PDAs, CPIs, the Anchor framework, and devnet deployment. Seats are limited.

🎧 Listen to This

Lightspeed

Lightspeed covers Blockworks' new Solana-focused Lightspeed IR platform and a report on Solana block building, examining the rivalry between Jito BAM and Harmonic, impacts on transaction ordering, fees, market structure, validator clients, and the push toward protocol-level solutions like MCP and application-controlled execution.

Solana’s Block Building Battle: Jito BAM vs. Harmonic

Follow me on X!

Thanks for reading ✌️

I hope you found something useful here! If you have any suggestions or feedback just let me know what you think.